Are you tired of hearing about life insurance but still confused about what exactly it means for your financial future? Let me break it down for you in simple terms. A triple A whole life policy is not just another insurance plan; it's a solid foundation for long-term security. Whether you're planning for retirement, securing your family's future, or building wealth, this policy could be your golden ticket. So, let's dive in and explore why everyone's talking about it.

Life insurance can sometimes feel like a maze of jargon and numbers, but don't worry. I've got you covered. In this guide, we'll demystify the concept of a triple A whole life policy and explain why it's worth considering. Think of it as your personal finance superhero, standing guard over your hard-earned money and ensuring it works for you, not against you.

Now, you might be wondering, "Why should I care about this?" Well, here's the deal: life is unpredictable. One moment you're crushing it at work, and the next, you're hit with an unexpected expense or tragedy. A triple A whole life policy offers more than just peace of mind—it gives you the tools to navigate life's twists and turns with confidence. Stick around, and we'll show you how.

Read also:Prmovies Your Ultimate Destination For Streaming Movies Online

What Exactly is a Triple A Whole Life Policy?

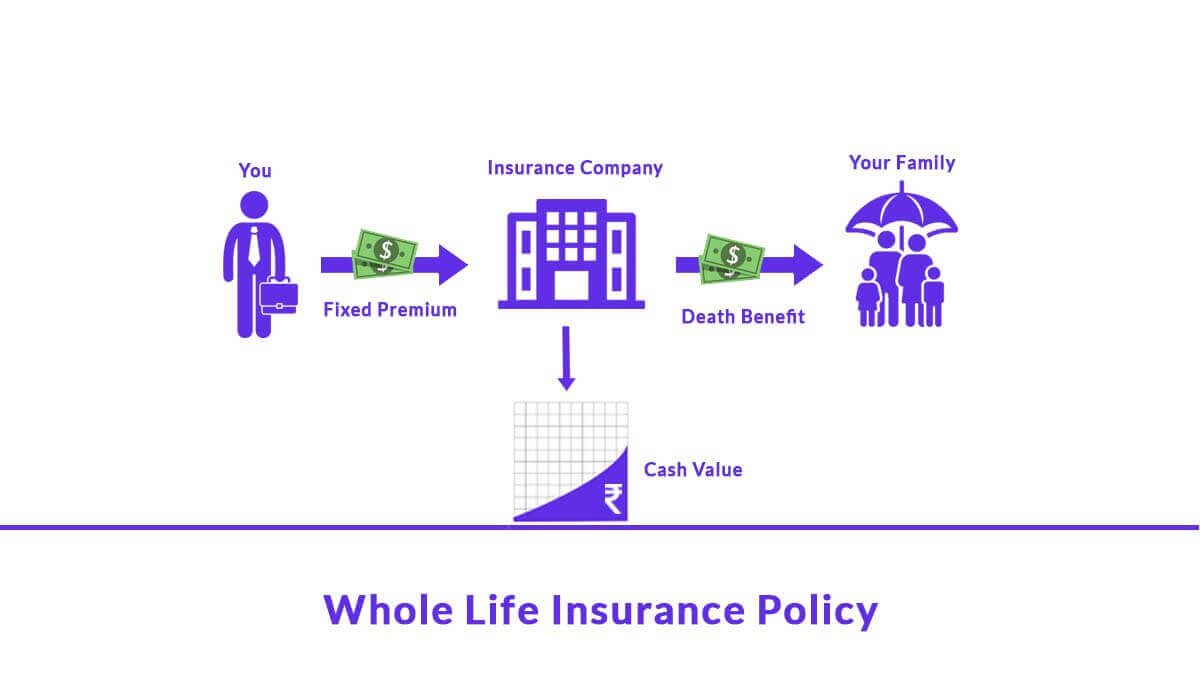

Let's start with the basics. A triple A whole life policy is a type of permanent life insurance that offers lifelong coverage, cash value accumulation, and guaranteed benefits. Unlike term life insurance, which only lasts for a specific period, this policy stays with you for as long as you pay the premiums. It's like having a financial safety net that grows stronger over time.

Here's the kicker: triple A whole life policies are backed by top-rated insurance companies, ensuring their stability and reliability. These companies are often rated "A++" or "A+" by independent agencies, which means they're financially sound and trustworthy. So, if you're looking for a policy that can weather economic storms, this might be your best bet.

Key Features of a Triple A Whole Life Policy

Now that we've covered the basics, let's zoom in on the features that make this policy so appealing:

- Lifetime Coverage: As long as you keep paying the premiums, your policy remains active, providing coverage for your entire life.

- Cash Value Accumulation: Your policy builds cash value over time, which you can borrow against or withdraw in the future.

- Guaranteed Death Benefit: Your beneficiaries are guaranteed to receive a payout when you pass away, offering them financial security.

- Fixed Premiums: The cost of your policy stays the same throughout your lifetime, making budgeting a breeze.

These features make triple A whole life policies a popular choice for individuals seeking long-term financial stability. It's not just insurance; it's an investment in your future.

Why Choose a Triple A Whole Life Policy Over Other Options?

With so many insurance options out there, you might be wondering why a triple A whole life policy stands out. Here's why:

First off, it's all about the guarantees. Unlike term life insurance, which only covers you for a set period, a triple A whole life policy offers lifelong protection. This means you won't have to worry about outliving your coverage or facing skyrocketing premiums as you age.

Read also:Bolly4ucom Your Ultimate Destination For Bollywood Entertainment

Second, the cash value component is a game-changer. As your policy accumulates value, you can tap into it for emergencies, investments, or even retirement. It's like having a personal savings account that doubles as insurance.

How Does the Cash Value Work?

The cash value of a triple A whole life policy grows over time through dividends or interest. Here's how it works:

- Each year, a portion of your premium goes toward building cash value.

- This value grows tax-deferred, meaning you don't pay taxes on the growth until you withdraw it.

- You can borrow against the cash value or withdraw it, though withdrawals may reduce your death benefit.

Think of it as a safety net within a safety net. Whether you need extra cash for a down payment on a house or want to supplement your retirement income, the cash value gives you flexibility and control.

Who Benefits from a Triple A Whole Life Policy?

Not everyone needs the same type of insurance, but a triple A whole life policy is a great fit for several groups:

- Young Families: If you're starting a family, securing a triple A whole life policy ensures your loved ones are protected no matter what.

- Retirees: For those nearing retirement, the policy's cash value can provide a steady source of income.

- Business Owners: Entrepreneurs can use the policy to fund buy-sell agreements or cover key employees.

Whether you're in your 20s or 60s, a triple A whole life policy can be tailored to meet your unique needs. It's all about finding the right fit for your financial goals.

Factors to Consider Before Purchasing

Before diving headfirst into a triple A whole life policy, there are a few things to keep in mind:

- Premium Costs: While the premiums are fixed, they can be higher than term life insurance. Make sure they fit within your budget.

- Policy Terms: Understand the terms and conditions, including any exclusions or limitations.

- Company Ratings: Choose a reputable insurance company with a strong financial rating.

Doing your homework upfront can save you headaches down the road. It's all about making an informed decision that aligns with your financial priorities.

How to Choose the Right Triple A Whole Life Policy

Picking the right policy can feel overwhelming, but it doesn't have to be. Here's a step-by-step guide:

- Assess Your Needs: Determine how much coverage you need and what features are most important to you.

- Compare Providers: Research different insurance companies and their offerings. Look for those with high ratings and positive reviews.

- Review the Fine Print: Read the policy details carefully, paying attention to premiums, cash value growth, and death benefits.

- Consult a Professional: If you're unsure, seek advice from a trusted financial advisor or insurance agent.

Remember, the goal is to find a policy that fits your lifestyle and financial goals. Don't rush the decision—take your time and choose wisely.

Common Misconceptions About Triple A Whole Life Policies

There are a few myths floating around about triple A whole life policies that need debunking:

- Myth 1: "Whole life insurance is too expensive." While premiums can be higher, the long-term benefits often outweigh the cost.

- Myth 2: "Term life insurance is better for everyone." Not true. Term policies only cover you for a set period, whereas whole life offers lifelong protection.

- Myth 3: "Cash value isn't worth it." On the contrary, the cash value can provide significant financial flexibility and security.

Don't let misconceptions cloud your judgment. Do your research and weigh the pros and cons before making a decision.

Real-Life Examples of Triple A Whole Life Policy Success

Let's look at a few real-life scenarios where a triple A whole life policy made a difference:

Case 1: John, a 35-year-old father of two, purchased a triple A whole life policy to ensure his family's financial security. Years later, when he faced unexpected medical bills, the policy's cash value helped cover the costs, preventing financial ruin.

Case 2: Sarah, a small business owner, used her policy's cash value to fund her company's expansion. The policy not only provided liquidity but also ensured her family's future in case anything happened to her.

These stories illustrate the versatility and value of a triple A whole life policy in real-world situations. It's not just insurance; it's a financial lifeline.

Statistical Insights and Industry Trends

According to recent data from the Insurance Information Institute, whole life insurance policies remain a popular choice among consumers. In 2022, approximately 60% of life insurance policies sold were permanent policies, including whole life. This trend reflects a growing awareness of the long-term benefits these policies offer.

Moreover, studies show that policies backed by top-rated insurance companies, like those offering triple A whole life policies, tend to perform better in terms of stability and growth. This data reinforces the importance of choosing a reputable provider when selecting a policy.

How to Maximize the Benefits of Your Triple A Whole Life Policy

Once you've purchased a triple A whole life policy, here's how to get the most out of it:

- Regular Reviews: Periodically review your policy to ensure it still meets your needs.

- Utilize Cash Value: Use the cash value for investments, emergencies, or retirement.

- Stay Informed: Keep up with industry trends and policy updates to make informed decisions.

Maximizing your policy's benefits requires proactive management and a long-term perspective. It's all about making the most of the tools at your disposal.

Tips for Maintaining Your Policy

Here are a few tips to help you maintain your triple A whole life policy:

- Pay your premiums on time to avoid lapses in coverage.

- Communicate with your insurance provider about any changes in your financial situation.

- Explore additional riders or features that could enhance your policy.

By staying engaged and informed, you can ensure your policy continues to serve you well for years to come.

Conclusion: Why a Triple A Whole Life Policy is Worth It

Let's recap: a triple A whole life policy offers lifelong coverage, cash value accumulation, and guaranteed benefits. It's a powerful tool for securing your financial future and providing peace of mind for your loved ones.

If you're ready to take the next step, consider reaching out to a trusted insurance professional or exploring policies from top-rated providers. Remember, the key is to choose a policy that aligns with your goals and fits within your budget.

So, what are you waiting for? Secure your future today and experience the benefits of a triple A whole life policy. Your future self—and your family—will thank you for it!

Table of Contents

- What Exactly is a Triple A Whole Life Policy?

- Why Choose a Triple A Whole Life Policy Over Other Options?

- Who Benefits from a Triple A Whole Life Policy?

- How to Choose the Right Triple A Whole Life Policy

- Real-Life Examples of Triple A Whole Life Policy Success

- How to Maximize the Benefits of Your Triple A Whole Life Policy

There you have it—a comprehensive guide to triple A whole life policies. Now go out there and make the most of your financial future!