Are you tired of feeling unsure about your financial future? Well, today’s the day to take charge! Triple A whole life insurance quote might just be the key to unlocking the peace of mind you’ve been craving. Whether you’re a young professional or a seasoned family leader, this type of insurance can be a game-changer. Let’s dive in and explore how it works, why it matters, and how you can get the best deal possible.

Life insurance might sound boring at first, but trust me, it’s one of the most important investments you’ll ever make. Think about it—what happens if something unexpected happens tomorrow? With triple A whole life insurance, you’re not just protecting yourself; you’re safeguarding the future of your loved ones. This isn’t just a plan; it’s a promise.

Before we jump into the nitty-gritty details, let’s get one thing straight: triple A whole life insurance is more than just a policy. It’s a comprehensive solution that guarantees coverage for your entire life, builds cash value over time, and offers flexibility when you need it most. Ready to learn more? Let’s go!

Read also:Gorecentercom Your Ultimate Hub For Gaming And Entertainment

Understanding Triple A Whole Life Insurance

First things first, let’s break down what exactly triple A whole life insurance is all about. At its core, this type of insurance provides lifelong coverage, meaning your beneficiaries will receive a payout no matter when you pass away. Unlike term life insurance, which only covers you for a specific period, triple A whole life insurance sticks with you for the long haul.

Key Features of Triple A Whole Life Insurance

Here’s where the magic happens. Triple A whole life insurance comes packed with some seriously cool features:

- Lifetime Coverage: As long as you keep paying your premiums, the policy stays active.

- Cash Value Accumulation: A portion of your premium goes into a savings component that grows over time.

- Guaranteed Death Benefit: Your beneficiaries will receive the agreed-upon payout when you pass away.

- Flexibility: You can borrow against the cash value or even surrender the policy for its cash value if needed.

Why Choose Triple A Whole Life Insurance?

Now that you know what it is, let’s talk about why it’s worth considering. For starters, triple A whole life insurance offers unparalleled security. Unlike other types of insurance, it doesn’t expire, ensuring your loved ones are protected no matter what. Plus, the cash value component can serve as a financial safety net during tough times.

Financial Stability for Your Loved Ones

Imagine this scenario: something happens to you, and your family is left without a primary income source. With triple A whole life insurance, they’ll have the financial resources to cover everything from everyday expenses to long-term goals like education and retirement. It’s not just an insurance policy; it’s a lifeline.

How Does Triple A Whole Life Insurance Work?

Let’s break it down step by step. When you purchase a triple A whole life insurance policy, you agree to pay a fixed premium for the rest of your life. In return, the insurance company promises to pay out a specified death benefit to your beneficiaries when you pass away. But here’s the kicker—the policy also accumulates cash value over time, which can be accessed if needed.

Factors That Affect Your Premium

Not all policies are created equal, and several factors can influence the cost of your triple A whole life insurance quote:

Read also:Zoe Jane Lewis Rising Star In The Spotlight

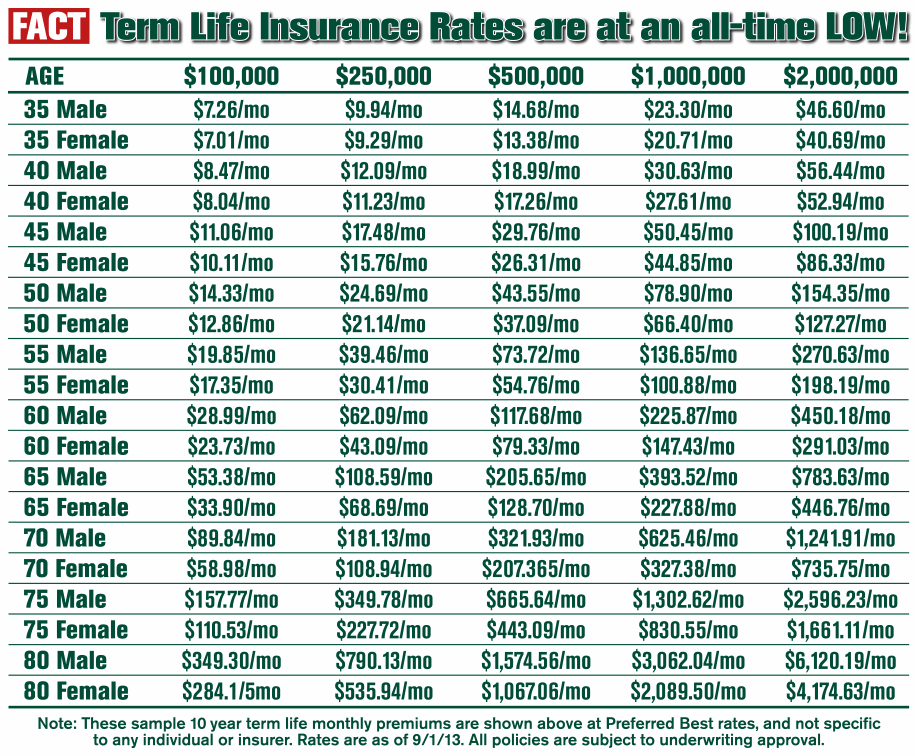

- Age: The younger you are when you purchase the policy, the lower your premiums will likely be.

- Health: Being in good health can significantly reduce your premium costs.

- Smoking Status: Smokers typically pay higher premiums than non-smokers.

- Policy Amount: The higher the death benefit, the higher the premium.

Getting the Best Triple A Whole Life Insurance Quote

Ready to find the perfect policy? Here’s how to get the best triple A whole life insurance quote:

Shop Around: Different insurance providers offer varying rates and benefits, so it pays to compare. Don’t settle for the first quote you receive—do your research and find the best deal.

Be Honest: When applying for a quote, provide accurate information about your age, health, and lifestyle. Misrepresenting facts can lead to complications down the road.

Consider Add-Ons: Some policies offer additional benefits, such as accidental death coverage or critical illness riders. These can enhance your protection but may increase your premium.

Common Mistakes to Avoid

Before you finalize your purchase, watch out for these common pitfalls:

- Underestimating Coverage Needs: Make sure the policy amount is sufficient to meet your family’s financial needs.

- Ignoring Cash Value: Understand how the cash value component works and how it can benefit you in the future.

- Skipping the Fine Print: Read the policy terms carefully to avoid surprises later on.

Benefits of Triple A Whole Life Insurance

There’s a reason why triple A whole life insurance is so popular. Here are some of the top benefits:

Tax Advantages

One of the coolest perks of triple A whole life insurance is the potential tax advantages. The cash value grows tax-deferred, meaning you won’t owe taxes on the gains until you withdraw them. And if you use the cash value to pay for policy premiums, it’s generally tax-free.

Guaranteed Cash Value Growth

Unlike some investment options, the cash value in a triple A whole life insurance policy grows at a guaranteed rate. This makes it a reliable choice for those seeking stability and predictability in their financial planning.

Comparing Triple A Whole Life Insurance with Other Options

Before you commit, it’s worth comparing triple A whole life insurance with other types of policies:

Term Life Insurance vs. Triple A Whole Life Insurance

Term life insurance is typically more affordable, but it only covers you for a set period. Once the term ends, so does the coverage. On the other hand, triple A whole life insurance offers lifelong protection and builds cash value, making it a better long-term investment.

Universal Life Insurance vs. Triple A Whole Life Insurance

Universal life insurance offers more flexibility in terms of premiums and coverage amounts, but it can be riskier due to its variable interest rates. Triple A whole life insurance, on the other hand, provides guaranteed benefits and predictable costs.

Who Should Consider Triple A Whole Life Insurance?

Triple A whole life insurance isn’t for everyone, but it’s an excellent choice for certain groups:

- Young Families: Protecting your loved ones is crucial when you have dependents.

- Business Owners: Ensuring financial stability for your business and employees.

- Retirees: Providing a legacy for your heirs or covering final expenses.

How to Apply for a Triple A Whole Life Insurance Quote

Ready to take the next step? Here’s how to apply for a triple A whole life insurance quote:

Step 1: Determine your coverage needs by considering factors like income replacement, debt repayment, and future expenses.

Step 2: Gather necessary documents, such as medical records and financial statements.

Step 3: Contact multiple insurance providers to compare quotes and choose the best option for your situation.

Tips for a Smooth Application Process

To ensure a seamless application process, keep these tips in mind:

- Be Prepared: Have all required information and documents ready before starting the application.

- Ask Questions: Don’t hesitate to clarify any doubts or concerns with the insurance provider.

- Review Carefully: Double-check the policy terms and conditions before signing on the dotted line.

Conclusion: Securing Your Tomorrow, Today

Triple A whole life insurance quote isn’t just a financial decision—it’s an emotional one. It’s about providing peace of mind for yourself and your loved ones, ensuring they’re taken care of no matter what life throws your way. By understanding the ins and outs of this type of insurance, you’re already one step ahead.

So, what are you waiting for? Take action today and secure your future with a triple A whole life insurance policy. Share this article with your friends and family, leave a comment below, or explore more resources on our website. Remember, life is unpredictable, but with the right insurance, you can face it with confidence.

Table of Contents

- Triple A Whole Life Insurance Quote: Your Ultimate Guide to Secure Your Future

- Understanding Triple A Whole Life Insurance

- Key Features of Triple A Whole Life Insurance

- Why Choose Triple A Whole Life Insurance?

- How Does Triple A Whole Life Insurance Work?

- Factors That Affect Your Premium

- Getting the Best Triple A Whole Life Insurance Quote

- Common Mistakes to Avoid

- Benefits of Triple A Whole Life Insurance

- Tax Advantages

- Guaranteed Cash Value Growth

- Comparing Triple A Whole Life Insurance with Other Options

- Term Life Insurance vs. Triple A Whole Life Insurance

- Universal Life Insurance vs. Triple A Whole Life Insurance

- Who Should Consider Triple A Whole Life Insurance?

- How to Apply for a Triple A Whole Life Insurance Quote

- Tips for a Smooth Application Process

- Conclusion: Securing Your Tomorrow, Today