When it comes to financial planning, the term "triple a universal life policy" might sound like a mouthful, but trust me, it’s a game-changer. Imagine having an insurance policy that not only protects your loved ones but also grows in value over time. That’s exactly what this policy offers. Whether you’re a young professional or a seasoned investor, understanding how this policy works can be a turning point in securing your financial future.

Now, before we dive deep into the nitty-gritty, let’s set the stage. A triple A universal life policy is more than just a fancy name—it’s a powerful tool that combines the best of both worlds: insurance and investment. It’s like having a safety net that also earns you money. Sounds too good to be true? Stick around, and I’ll break it down for you.

But here’s the thing: not all policies are created equal. In this guide, we’ll explore everything you need to know about triple A universal life policies, from their benefits to potential drawbacks. By the end of this article, you’ll have a clear understanding of why this policy might be the missing piece in your financial puzzle.

Read also:Aishah Sofey Ed The Rising Star In The Entertainment World

What is a Triple A Universal Life Policy?

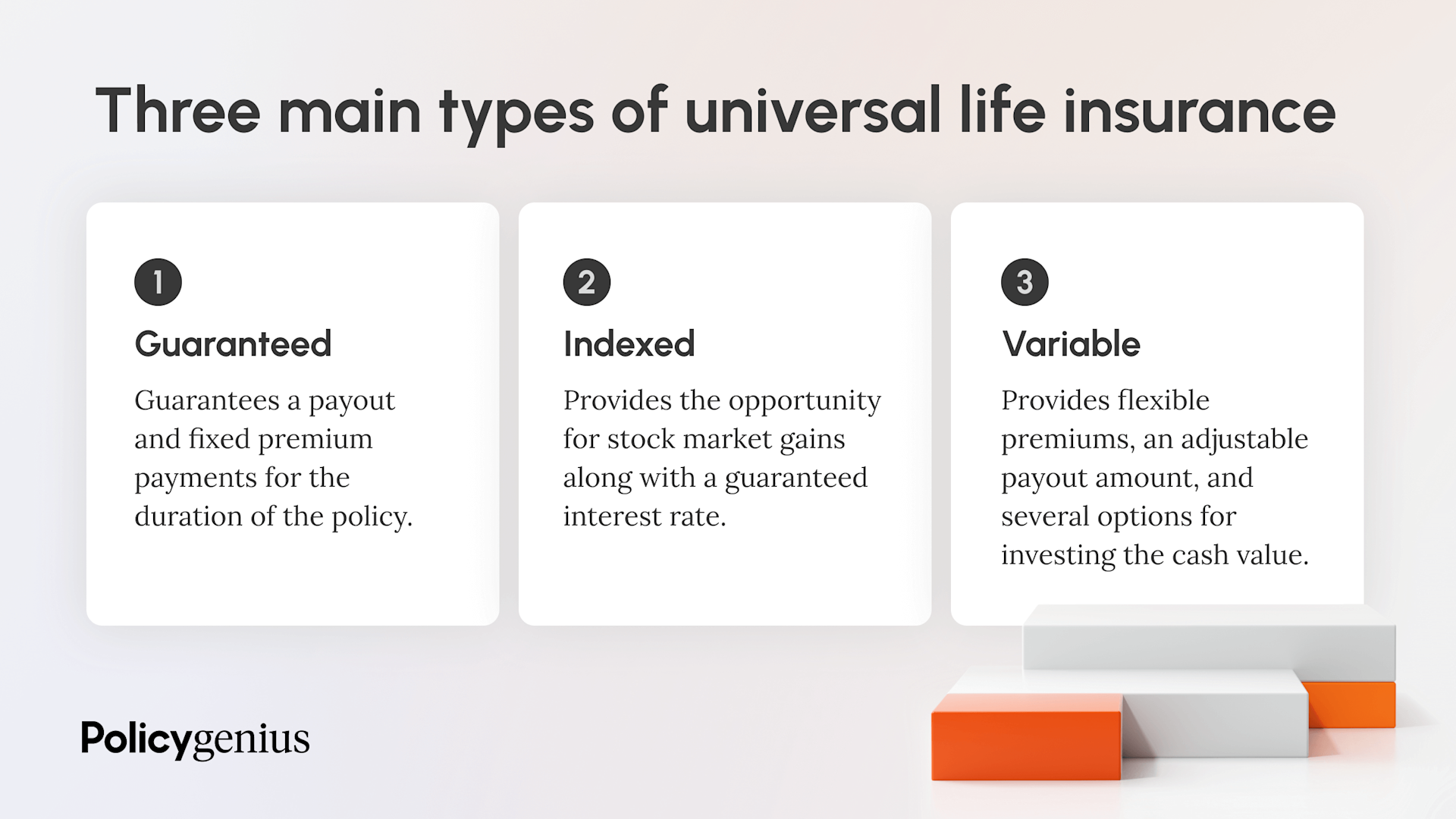

Let’s start with the basics. A triple A universal life policy is essentially a type of permanent life insurance that offers flexibility, cash value growth, and guaranteed death benefits. Unlike traditional term life insurance, which only provides coverage for a specific period, this policy stays with you for life. The "triple A" part refers to its high rating in terms of security, stability, and performance.

Here’s why it’s a big deal: this policy allows you to customize your premium payments and coverage amount based on your financial needs. You can adjust the premiums if you’re going through a tight budget month or increase the coverage if your family grows. Plus, the cash value component grows tax-deferred, giving you a nice little bonus over time.

Think of it as a Swiss Army knife for your finances—versatile, reliable, and always ready to serve. Whether you’re planning for retirement, funding your kids’ education, or simply leaving a legacy, this policy has got your back.

Why Choose a Triple A Universal Life Policy?

Choosing the right insurance policy can feel overwhelming, but here’s why a triple A universal life policy should be on your radar. First off, it offers unparalleled flexibility. Unlike other policies where you’re locked into fixed premiums and coverage, this one lets you tweak things as your life changes. Need more coverage? Done. Want to pause payments for a while? No problem.

Another major perk? The cash value component. This is where your premiums accumulate over time, earning interest and growing in value. And guess what? You can even borrow against this cash value if you need a financial boost. It’s like having an emergency fund built right into your insurance policy.

Plus, the death benefit is guaranteed, meaning your loved ones will be taken care of no matter what. That kind of peace of mind is priceless, don’t you think?

Read also:Hd Hub 4ucom 2024 Your Ultimate Guide To Streaming Movies And Shows

How Does a Triple A Universal Life Policy Work?

Now that we know what it is and why it’s awesome, let’s talk about how it actually works. At its core, a triple A universal life policy operates on two main components: the insurance portion and the cash value portion. Here’s a quick breakdown:

- Insurance Portion: This is the part that pays out the death benefit to your beneficiaries when you pass away. It’s the primary reason people buy life insurance.

- Cash Value Portion: This is where the magic happens. A portion of your premium payments goes into a cash account that earns interest over time. You can access this cash value later in life, whether for retirement, emergencies, or even funding big purchases like a house.

One cool feature is the ability to adjust your premiums and coverage. For example, if you’re having a good year financially, you can pay extra premiums to boost your cash value. On the flip side, if things get tight, you can lower your payments without losing coverage. It’s all about flexibility and control.

Benefits of a Triple A Universal Life Policy

Let’s dive into the benefits that make this policy a standout choice. Here’s what you get when you sign up:

- Guaranteed Death Benefit: Your loved ones will receive a lump sum payment upon your passing, ensuring their financial security.

- Flexibility: Customize your premiums and coverage to fit your changing needs.

- Tax-Deferred Growth: The cash value in your policy grows tax-free, allowing it to compound over time.

- Access to Cash Value: Borrow against your cash value if you need funds for emergencies or investments.

- Long-Term Stability: With its triple A rating, you can trust that your policy will remain stable and reliable.

These benefits make it a solid choice for anyone looking to secure their financial future while enjoying the flexibility to adapt to life’s twists and turns.

Potential Drawbacks to Consider

While a triple A universal life policy sounds amazing, it’s not without its downsides. Here are a few things to keep in mind:

- Higher Premiums: Compared to term life insurance, the premiums for a universal life policy can be significantly higher.

- Complexity: Understanding how the cash value grows and how premiums are allocated can be tricky for some people.

- Loan Interest: If you borrow against your cash value, you’ll need to pay interest on the loan, which can eat into your earnings.

That being said, these drawbacks are manageable if you do your homework and work with a trusted financial advisor. It’s all about weighing the pros and cons and deciding if this policy aligns with your financial goals.

Understanding the Costs

Cost is always a major consideration when it comes to insurance. With a triple A universal life policy, you’ll pay higher premiums upfront, but the long-term benefits often outweigh the initial expense. Here’s how it breaks down:

First, there’s the base premium, which covers the cost of insurance. Then, there’s the additional premium you pay to fund the cash value account. The exact amount will depend on factors like your age, health, and the coverage amount you choose. It’s important to shop around and compare quotes from different providers to ensure you’re getting the best deal.

Who Should Consider a Triple A Universal Life Policy?

This policy isn’t a one-size-fits-all solution. It’s best suited for individuals who:

- Want long-term financial security for their loved ones.

- Are looking for a flexible insurance option that grows in value over time.

- Have the financial means to pay higher premiums upfront.

- Plan to hold the policy for many years, allowing the cash value to grow.

Whether you’re a young family looking to secure your children’s future or a retiree seeking a steady income stream, this policy could be the perfect fit.

Is It Right for You?

Before jumping in, ask yourself these questions:

- Do I have a stable income to cover the higher premiums?

- Am I comfortable with the complexity of managing cash value and premiums?

- Do I need the flexibility to adjust coverage and payments as needed?

If you answered yes to most of these, a triple A universal life policy might be worth exploring further.

How to Choose the Right Policy

Choosing the right policy involves a bit of research and some careful consideration. Here are a few tips to help you make the best decision:

- Shop Around: Compare quotes from multiple providers to ensure you’re getting competitive rates.

- Read the Fine Print: Understand how the cash value grows, what fees are involved, and any restrictions on accessing your funds.

- Consult a Professional: Work with a licensed financial advisor who can guide you through the process and help you choose a policy that aligns with your goals.

Remember, the policy you choose should reflect your unique financial situation and long-term objectives.

What to Look for in a Provider

Not all insurance providers are created equal. When choosing a provider, look for:

- A strong financial rating (preferably triple A).

- A proven track record of stability and reliability.

- Transparent fee structures and clear communication.

Doing your due diligence upfront can save you a lot of headaches down the road.

Case Studies and Real-Life Examples

Let’s look at a couple of real-life examples to see how a triple A universal life policy can work in practice.

Example 1: John, a 40-year-old business owner, wanted to secure his family’s future while building a nest egg for retirement. He opted for a triple A universal life policy, paying higher premiums in the early years to maximize his cash value. By the time he turned 60, his cash value had grown significantly, allowing him to supplement his retirement income.

Example 2: Sarah, a single mother of two, needed a policy that offered flexibility. She chose a triple A universal life policy that allowed her to adjust her premiums based on her income fluctuations. This flexibility gave her peace of mind knowing she could always afford coverage for her kids.

Conclusion

In summary, a triple A universal life policy is a powerful tool for anyone looking to secure their financial future. It offers flexibility, cash value growth, and guaranteed death benefits, making it a versatile choice for a wide range of individuals. While it may come with higher premiums and some complexity, the long-term benefits often outweigh the initial costs.

So, what’s the next step? If you’re interested in learning more, reach out to a trusted financial advisor or insurance provider. They can help you explore your options and find a policy that fits your needs. And don’t forget to share this article with friends and family who might benefit from the information. Together, we can all take steps toward a more secure financial future.

Table of Contents

- What is a Triple A Universal Life Policy?

- Why Choose a Triple A Universal Life Policy?

- How Does a Triple A Universal Life Policy Work?

- Benefits of a Triple A Universal Life Policy

- Potential Drawbacks to Consider

- Understanding the Costs

- Who Should Consider a Triple A Universal Life Policy?

- How to Choose the Right Policy

- Case Studies and Real-Life Examples

- Conclusion