Let’s cut to the chase, folks. A triple A term life policy is more than just a fancy insurance term—it’s your safety net, your peace of mind, and your way of ensuring that your loved ones are taken care of when you’re no longer around. Now, I know what you’re thinking—life insurance sounds complicated, right? But trust me, by the time you finish this article, you’ll be a pro at understanding what triple A term life policies are all about and why they matter.

Life insurance is one of those things we don’t want to think about until it’s too late. But here’s the thing—no one plans to leave early, but life has its own plans. That’s where a solid triple A term life policy comes in. It’s like having a financial superhero in your corner, ready to step in and protect your family if the unthinkable happens.

So, buckle up because we’re diving deep into the world of triple A term life policies. By the end of this ride, you’ll know everything from the basics to the nitty-gritty details. And hey, who doesn’t love a good insurance breakdown that actually makes sense?

Read also:Unleash The Power Of Movies4u Download Your Ultimate Guide To Streaming Bliss

What Exactly Is a Triple A Term Life Policy?

A triple A term life policy is essentially a type of life insurance that provides coverage for a specific period, usually 10, 20, or 30 years. The “triple A” part refers to the premium class, which means it’s designed for individuals who meet strict underwriting criteria. Think of it as the VIP lane of term life insurance—only the healthiest applicants qualify.

Here’s the deal: if you pass away during the term of the policy, your beneficiaries receive a lump sum payout, also known as the death benefit. It’s a simple concept, but the impact can be life-changing for your loved ones. Imagine covering mortgage payments, college tuition, or even everyday expenses without breaking a sweat.

Why Choose a Triple A Term Life Policy?

Now, you might be wondering, “Why should I go for a triple A term life policy instead of a regular term policy?” Great question! Here’s the lowdown:

- Higher coverage amounts at lower premiums

- Guaranteed acceptance for those who meet the health requirements

- No medical exams required in some cases

- Flexibility to customize the policy based on your needs

It’s like getting the best of both worlds—affordable premiums with maximum protection. Plus, who doesn’t love saving money while securing their family’s future?

Breaking Down the Key Features of Triple A Term Life Policies

Let’s break it down into bite-sized chunks so you can fully grasp what makes triple A term life policies tick. Here are the key features you need to know:

1. Coverage Period

Triple A term life policies typically offer coverage for a set number of years, ranging from 10 to 30 years. This means you’re protected during the most critical stages of your life, such as when you have young kids or a mortgage to pay off.

Read also:Buzzing Around Why Bees Are Natures Little Heroes

2. Death Benefit

The death benefit is the amount of money your beneficiaries receive if you pass away during the policy term. It’s usually a lump sum payment that can be used for anything from funeral expenses to paying off debts.

3. Premiums

One of the biggest advantages of triple A term life policies is the affordable premiums. Since they’re designed for healthy individuals, the cost is significantly lower compared to other types of insurance.

Who Should Consider a Triple A Term Life Policy?

Not everyone needs a triple A term life policy, but it’s perfect for certain groups of people. Here’s who should consider getting one:

- Young professionals looking for affordable coverage

- Families with dependents who rely on your income

- Business owners wanting to protect their assets

- Individuals in good health who want maximum protection

If any of these descriptions sound like you, then a triple A term life policy could be a game-changer for your financial security.

How Much Does a Triple A Term Life Policy Cost?

Cost is always a big factor when it comes to insurance, and triple A term life policies are no exception. The good news? They’re surprisingly affordable, especially if you’re in excellent health. Here’s a rough estimate of what you can expect to pay:

- $20-$50 per month for $250,000 coverage

- $30-$70 per month for $500,000 coverage

- $50-$100 per month for $1,000,000 coverage

Of course, prices vary depending on factors like age, gender, and lifestyle choices. But as a general rule, triple A term life policies offer some of the lowest premiums on the market.

The Underwriting Process: What to Expect

Before you can get your hands on a triple A term life policy, you’ll need to go through the underwriting process. Don’t panic—it’s not as scary as it sounds. Here’s what you can expect:

1. Application

You’ll start by filling out an application form, which includes questions about your health, lifestyle, and family medical history. Be honest here—any misstatements could void your policy down the line.

2. Medical Exam (Optional)

Some policies require a medical exam, while others don’t. If you’re in excellent health, this step is usually quick and painless. It involves a basic check-up, including blood tests and a review of your medical records.

3. Approval

Once your application is reviewed, you’ll receive an approval or denial notice. If approved, your policy will be activated, and you’ll start paying premiums immediately.

Common Misconceptions About Triple A Term Life Policies

There are a few myths floating around about triple A term life policies that we need to clear up. Here are the top misconceptions:

- Myth #1: It’s only for wealthy people. Wrong! Anyone can benefit from a triple A term life policy, regardless of income level.

- Myth #2: It’s complicated to understand. Not true! With the right guidance, anyone can grasp the basics of term life insurance.

- Myth #3: It’s not worth the money. On the contrary, it’s one of the most cost-effective ways to protect your loved ones.

So, don’t let these myths hold you back from getting the protection you need.

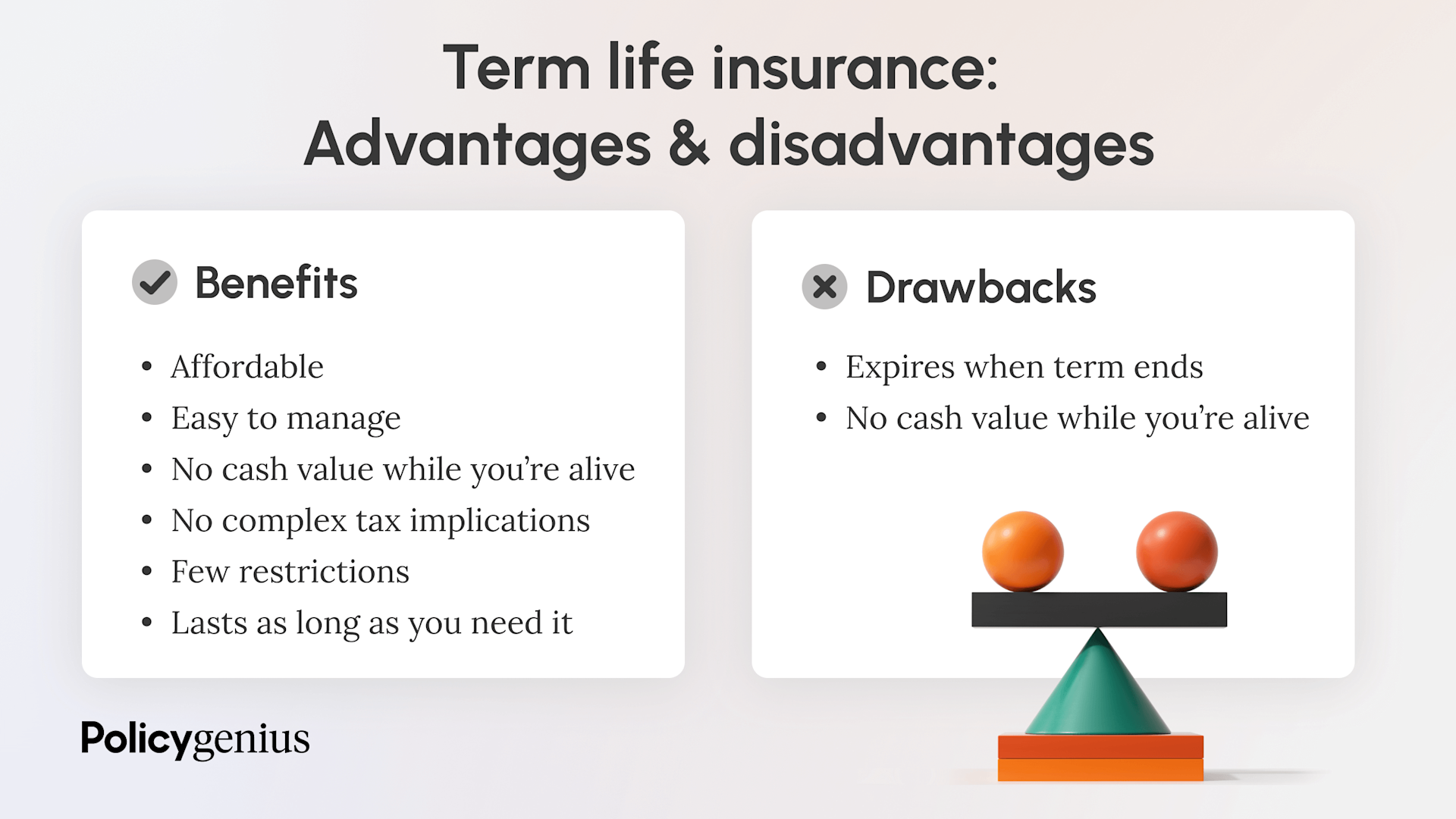

Pros and Cons of Triple A Term Life Policies

Like anything in life, triple A term life policies have their pros and cons. Let’s weigh them out:

Pros

- Affordable premiums

- Simple application process

- No medical exam required in some cases

- Guaranteed coverage for the policy term

Cons

- Strict underwriting criteria

- No cash value component

- Policy expires at the end of the term

It’s all about finding the right balance for your needs and budget. If you’re okay with the trade-offs, a triple A term life policy could be a great fit for you.

How to Choose the Best Triple A Term Life Policy

Picking the right policy can feel overwhelming, but it doesn’t have to be. Here are a few tips to help you make the best decision:

- Shop around and compare quotes from multiple providers

- Consider your coverage needs and budget

- Read reviews and check the insurer’s reputation

- Ask questions and clarify any doubts with your agent

Remember, the goal is to find a policy that fits your unique situation. Don’t settle for anything less than what you deserve.

Conclusion: Take Action Today

Alright, we’ve covered a lot of ground here, and I hope you feel more confident about triple A term life policies. They’re a fantastic way to protect your loved ones and secure your financial future. So, what’s stopping you from taking the next step?

Here’s my challenge to you: reach out to a trusted insurance agent or start researching online today. The sooner you act, the sooner you can enjoy the peace of mind that comes with knowing your family is protected.

And don’t forget to share this article with anyone who might benefit from it. Knowledge is power, and the more people understand triple A term life policies, the better off we all are.

Table of Contents

- What Exactly Is a Triple A Term Life Policy?

- Why Choose a Triple A Term Life Policy?

- Breaking Down the Key Features of Triple A Term Life Policies

- Who Should Consider a Triple A Term Life Policy?

- How Much Does a Triple A Term Life Policy Cost?

- The Underwriting Process: What to Expect

- Common Misconceptions About Triple A Term Life Policies

- Pros and Cons of Triple A Term Life Policies

- How to Choose the Best Triple A Term Life Policy

- Conclusion: Take Action Today